What You Need To Know About

the Child Tax Credit and

Earned Income Tax Credit

the Child Tax Credit and

Earned Income Tax Credit

Child Tax Credit (CTC)

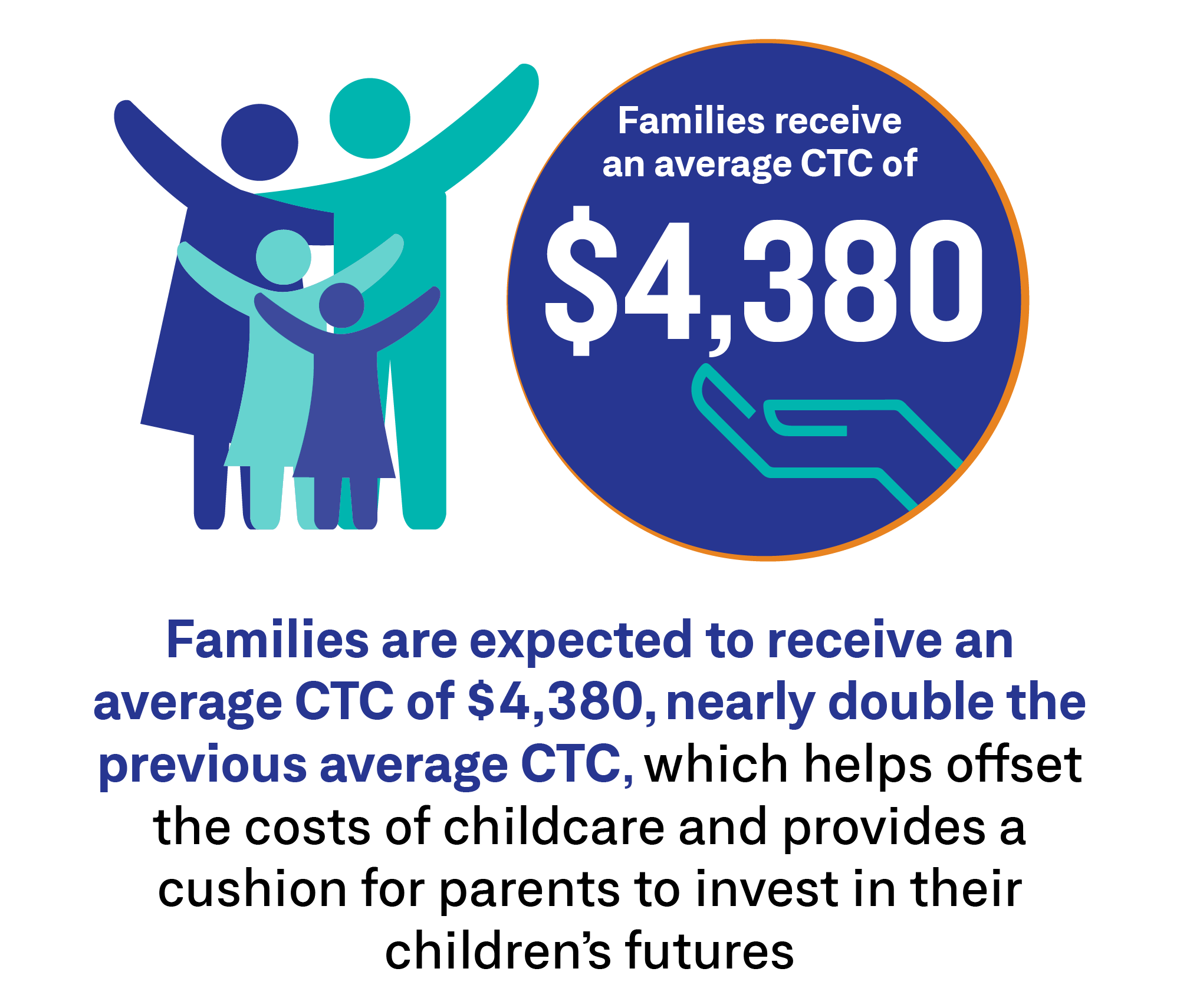

Parents eligible to claim the temporarily expanded CTC can receive up to $3,600 per child under age 6 and up to $3,000 per child ages 6 to 17. If your income is less than $73,000, check out these free filing resources.

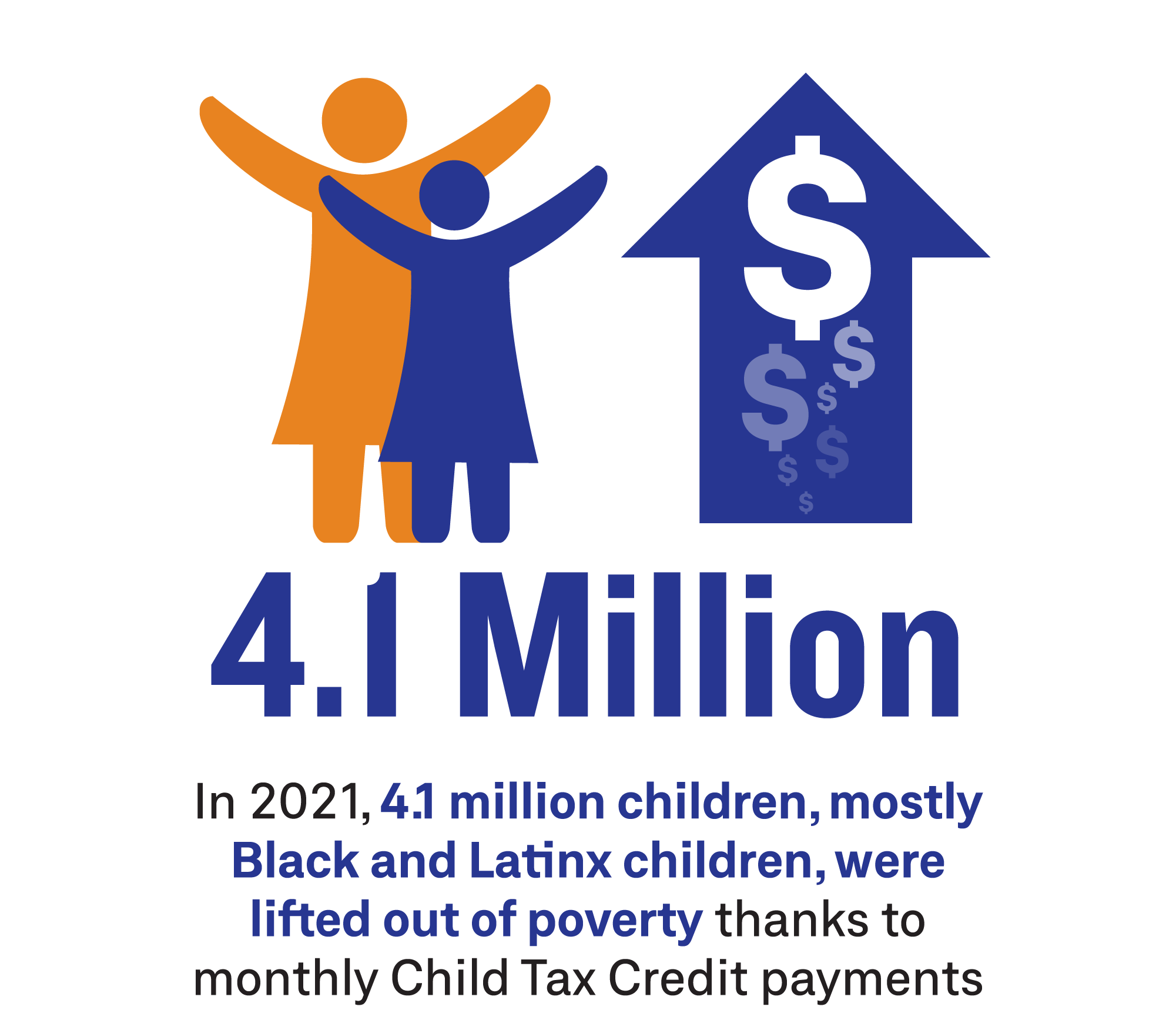

Data Source: Center on American Progress

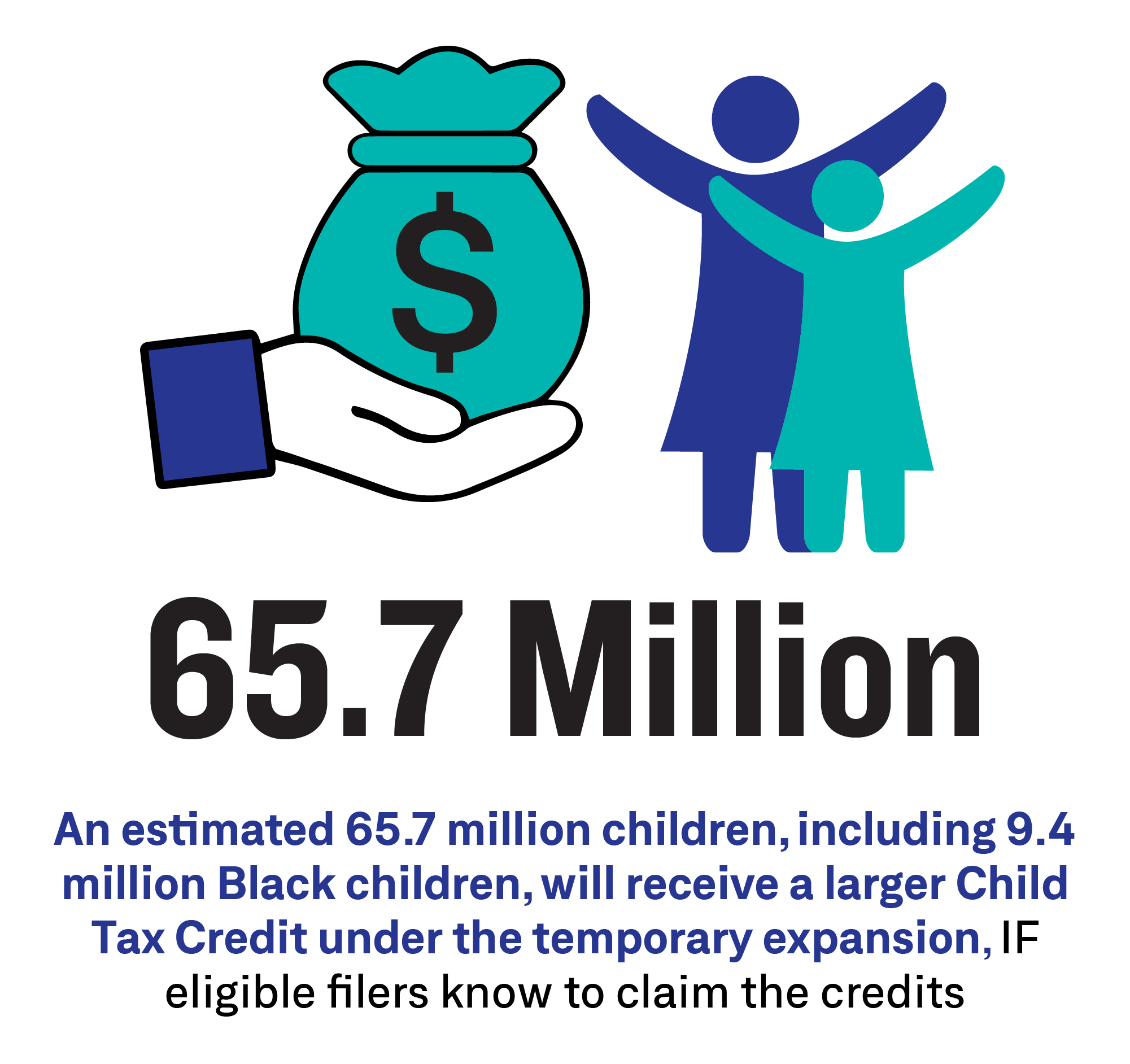

This year, for the first time in history, almost all Black children’s families will be eligible for the Child Tax Credit, allowing them to invest in their future success.

Americans who don’t owe taxes (because they make under $12,550 for single filers and under $25,100 filing jointly) can file “express” simplified returns from May through November. Bookmark this page to come back to “Get Your Refund” and claim your money whenever you’re ready to file.

The temporarily expanded Child Tax Credit can help deliver greater economic support to even more children nationwide— including 17.5 million Latinx children, 9.4 million Black children, and 2.8 million Asian American children—IF eligible filers know to claim the credits.

Eligible parents that typically do not owe taxes (because they make under $12,550 for single filers and under $25,100 filing jointly) who file their taxes by November can claim the Child Tax Credit. Parents who filed last year and claimed the Advance Child Tax Credit payments (AdvCTC) must file this year in order to receive the second half of the payments that they are owed. These resources are too important to miss out on in 2022.

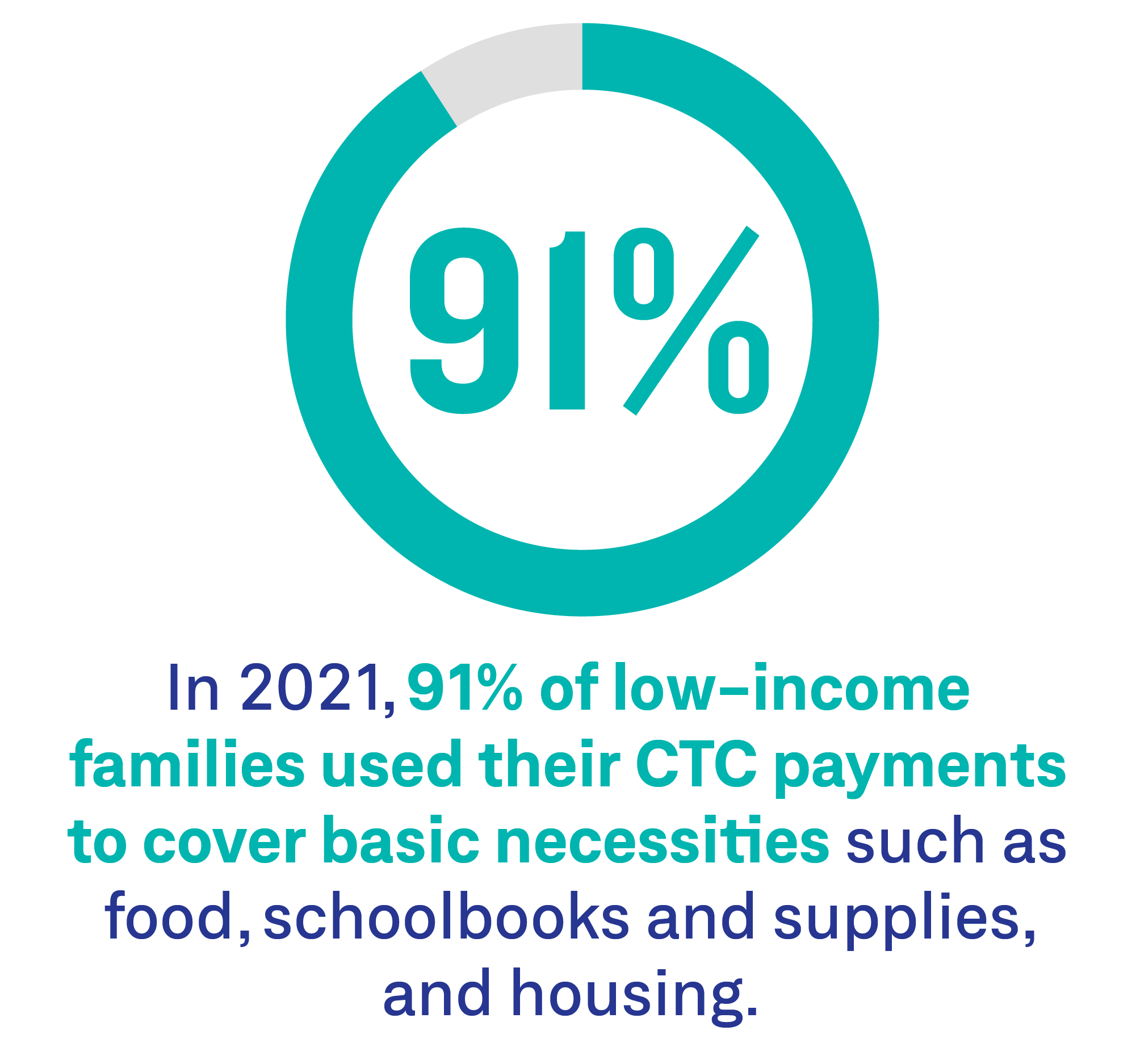

In 2021, 91% of low-income families used their CTC payments to cover basic necessities such as food, education, and housing. In particular, parents spent the savings on schoolbooks and supplies, tuition, after-school programs, and transportation to and from school.

Earned Income Tax Credit (EITC)

Do you know someone who earned less than they did last year, got married or divorced, or who has more or fewer dependents than last year? They might be eligible for the expanded Earned Income Tax Credit and are at risk of leaving money on the table if they do not claim it! The EITC will provide an estimated $12.4 billion boost to filers, amounting to an average of $740 each for Americans who make less than $23,000. 17 million Americans are newly eligible to claim a new maximum EITC for childless workers of $1500. Previously, the EITC for childless workers was only $540 and filers had to make less than $16,000. (Center on Budget and Policy Priorities)

All childless employees who are 19 years old or older are eligible for the Earned Income Tax Credit for the first time this year! The EITC helps workers invest in their futures by providing a supplement to their income, thereby benefitting the entire economy. The new policy isn’t guaranteed for next year – the time to stake a claim is now.

Are you connected to a grandparent raising a grandchild, a foster mom, or an auntie who is the primary caretaker for nieces and nephews? The IRS indicates non-traditional families are likely to miss out on the Earned Income Tax Credit, despite being eligible. Check out and share the resources below.

CTC and EITC Resources

Stay up to date on BEA Foundation developments by signing up for our mailing list.