One of the most beneficial tax credits in our complex tax code is the Child Tax Credit. The Child Tax Credit helps offset tax liability for parents to address economic challenges that burden working families. Despite Congress’s enactment of the original Child Tax Credit into law in the 1990s, the wealth gap between Black Americans and their white counterparts has widened significantly over the last 30 years.

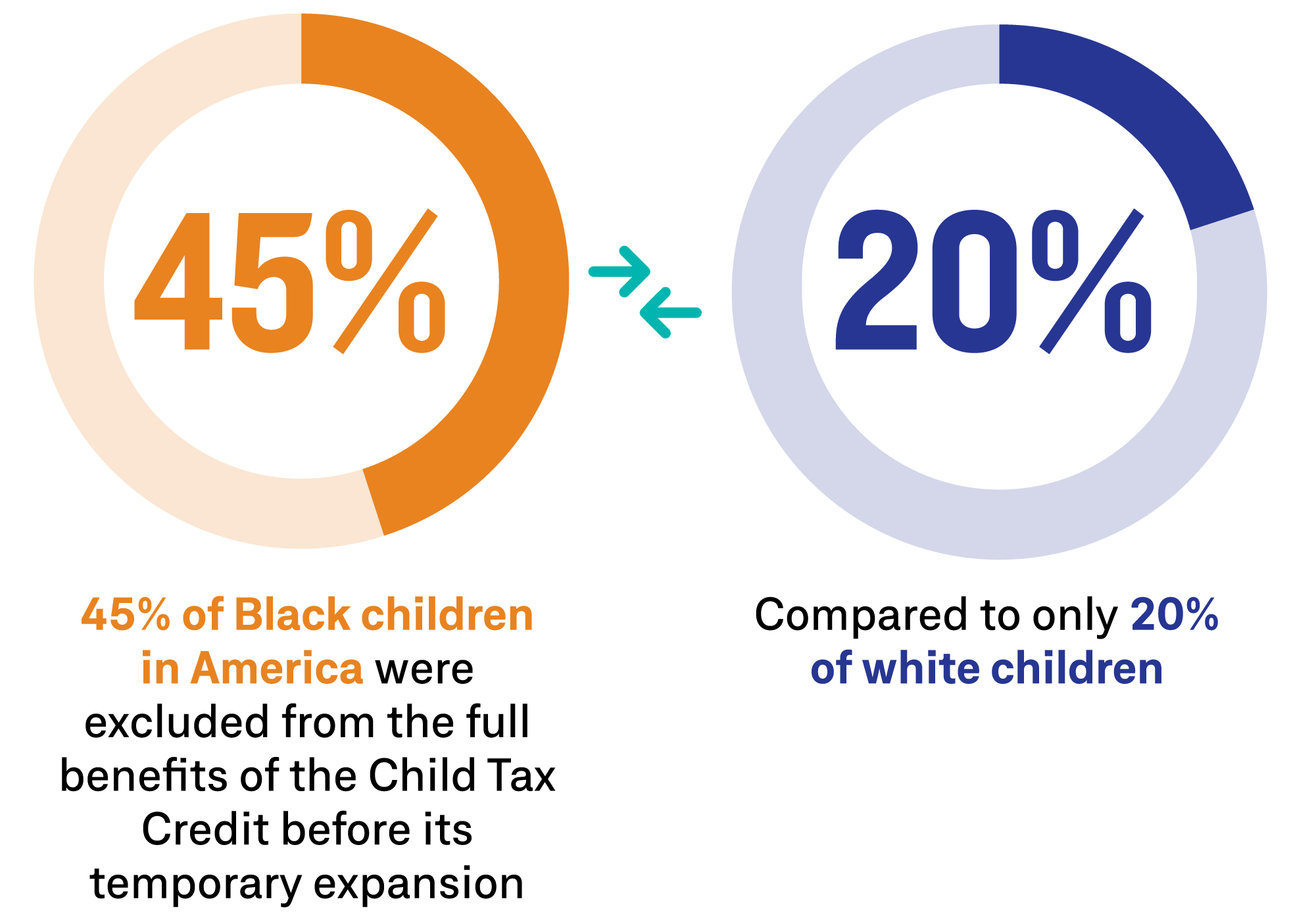

45% of Black children in America were excluded from the full benefits of the Child Tax Credit before its temporary expansion – compared to only 20% of white children.

When Congress enacted the Child Tax Credit into law in 1997, it codified specific economic criteria that determined eligibility for the tax credit. These criteria excluded 50% of Black children from receiving the full benefits of the policy.